Trade Like You Know

What the F**k You're Doing.

Signals that explain themselves, a journal that tracks your psychology,

and an AI coach that calls out your patterns before you repeat them.

No wallet connection. No BS. Just the signals that actually matter.

Sync your trades from

Here's Why You Keep Bleeding Money

The 3 Reasons You're Losing

You're Drinking from a Fire Hose

Twitter threads. Discord alpha. TradingView alerts. You're drowning in noise while the signals that actually matter slip right past you.

You're Your Own Worst Enemy

You watched your position go red, panicked, sold at the bottom, and then watched it rip 40% without you. We've all been there. It's not a discipline problem — it's a visibility problem.

You're Flying Blind

No journal. No data. Same dumb mistakes on loop like Groundhog Day but with real money. You can't fix what you can't see.

Any of these hit close to home? You're not alone. Here's the fix.

Trading With Thrive

+$2,847

Monthly gain*

Click items to learn more • Based on average user improvement data

This Is What Actually Works

These aren't Figma mockups or some designer's wet dream. This is the real product. Click around. Break something. We dare you.

Stop Guessing. Start Knowing.

Funding flips. Liquidation cascades. Whale accumulation. The stuff that moves markets before Twitter catches wind. Each signal comes with AI that tells you what the hell it means — not just that something happened, but whether you should give a damn.

- Click any card — the AI spills everything

- Filter by bullish, bearish, or "who knows"

- 10+ signal types. 100+ assets. Zero guesswork.

- Real-time. Not that 15-minute-delayed garbage.

Market Signals

2 min ago

What Happened

Funding rates flipped positive after 72 hours in negative territory. Shorts are now paying longs — this historically precedes significant upward moves.

Why It Matters

Negative to positive funding flips signal a sentiment shift. Shorts are capitulating while longs are gaining confidence. The last 3 similar setups resulted in 4-8% moves within 48 hours.

What Traders Do Next

Many traders use this as a long entry signal, often with stops below recent lows. Conservative traders wait for price confirmation above resistance.

Funding Rate

+0.0089%

Previous

-0.0234%

Flip Duration

72h

8 min ago

Unusual volume detected — 340% above 24h average. Large buyers accumulating on Binance and Coinbase. Smart money positioning detected.

23 min ago

$47M in longs liquidated in 15 minutes. Cascade liquidations triggered — watch for support levels and potential continuation.

35 min ago

Open interest surged 34% in 6 hours without significant price movement. Large positions being built on both sides.

Click any signal to expand full AI analysis

Trade Journal

Log & analyze your trades

Click "+ Add Trade" to try the form

Finally, a Journal You'll Actually Use

Spreadsheets are where trading journals go to die. This one takes 10 seconds to fill out. Tracks your entries, exits, P&L — and the emotion that made you pull the trigger. That last part is where it gets interesting.

- Hit "+ Add Trade" — go ahead, try it

- P&L calculates as you type. Math is hard.

- Emotion tracking exposes your expensive patterns

- CSV import because we're not savages

Your Numbers Don't Lie (Even If You Do)

That “pretty good month” you had? Let's see the receipts. Win rate. Profit factor. Which assets you crush and which ones crush you. No more selective memory — just cold, unforgiving data that makes you a better trader.

- Click around — each tab tells a different story

- Watch the stats animate because we're extra

- See which coins love you and which hate you

- Your strengths and weaknesses, no sugar-coating

Performance

Track your trading edge

+$0

Total P&L

0.0%

Win Rate

0.00

Profit Factor

0

Trades

Click tabs to explore different analytics views

Watchlist

Configure your alerts

Assets to Watch

Signal Types

Funding Rates

Rate flips & divergences

Volume Spikes

Unusual trading volume

Liquidations

Large liquidation events

Exchange Flows

Inflows & outflows

Alert Frequency

Click assets and toggles to customize

Stop Getting Pinged About Coins You Don't Trade

BTC only? ETH and SOL? Some weird L2 nobody's heard of? Pick your assets. Pick your signal types. Get alerts when YOU want them. Your phone, your rules.

- Tap assets to add or remove — it's not rocket science

- Toggle signal types like a DJ mixing a set

- Real-time, hourly, or daily — your call

- Changes save instantly. We respect your time.

The Coach That Sees What You Can't

Every Sunday, AI rips through your trades and tells you what you actually did — not what you think you did. What improved. What needs to stop. A performance score that'll either make your day or ruin your brunch. Either way, you'll be better for it.

- Click the breakdown — prepare to be humbled

- Your wins, ranked. Celebrate responsibly.

- The patterns costing you money, with receipts

- A score out of 100. Ego not included.

Weekly AI Review

Dec 30 - Jan 5 • 23 trades analyzed

Performance Score

0/100

Analysis

Your trading this week showed significant improvement in discipline. You held winners longer and cut losers faster. However, there's a pattern of overtrading after losses that needs attention.

Click to expand the full AI analysis

Multi-Criteria Alert Builder

Shorts paying longs — bullish pressure building

Smart money accumulating aggressively

Key psychological level breached

Click conditions to toggle • Switch AND/OR to see logic change • Watch for the trigger

One Alert Is Amateur Hour. Pros Stack Conditions.

Funding rate spiking? Cool. But funding rate spiking + volume surge + price breaking resistance? That's when the smart money moves. Stack up to 10 conditions. Let the algorithm do the watching. You do the trading.

- AND/OR logic — your rules, your edge

- 10+ data sources from funding to whale flows

- Watch conditions light up in real-time

- Get pinged only when YOUR setup appears

Tools the Pros Use

Liquidation heatmaps, funding rate monitors, and whale tracking — the institutional-grade tools that give you an edge.

See Where Positions Will Break

Visualize liquidation clusters across price levels. Know where the cascade triggers are before they happen — the same data hedge funds pay thousands for.

- Interactive heatmap by price level

- Long vs short liquidation density

- Click "Simulate Cascade" to see chain reactions

- Switch between BTC, ETH, and SOL

Liquidation Heatmap

BTC/USDT • Real-time levels

Exchange-by-Exchange Funding

See who's paying who across all major exchanges. Spot divergences before they resolve.

Funding Rates

BTC Perpetual • Updated every 8h

Significant difference between exchanges — potential arbitrage opportunity

8h History

Click an exchange to isolate • Positive = longs pay shorts

Follow the Smart Money

Watch large holders move funds in real-time. Exchange outflows often signal accumulation.

Smart Money Tracker

Real-time whale & fund movements

Exchange Inflows

$0M

Withdrawals

$0M

Smart Money

Binance

Coinbase

Kraken

OKX

🔴 Smart money depositing to exchanges — Potential distribution

The Edge That Pros Use to Time Entries

Hidden divergences are the market's best-kept secret. When price makes a higher low but momentum makes a lower low, smart money knows what's coming next. Most traders miss them entirely.

Bullish Hidden Divergence

Price higher low + momentum lower low = Uptrend continuation imminent

Bearish Hidden Divergence

Price lower high + momentum higher high = Downtrend continuation likely

- Click any row to see the AI interpretation

- 4+ timeframes aligned = High probability trade

- Hover cells to see individual divergence strength

- Real-time scanning across 8 major assets

Hidden Divergence Heatmap

| Asset | 5M | 15M | 30M | 1H | 4H | 1D | 1W | Confluence |

|---|---|---|---|---|---|---|---|---|

| Strong Bullish | ||||||||

| Moderate Bullish | ||||||||

| Strong Bearish | ||||||||

| Choppy | ||||||||

| Neutral |

Stop Trading Against the Hidden Trend

Ever taken a “perfect” setup that immediately went against you? You probably missed the hidden divergence screaming that the trend was about to continue — without you.

Win rate when 4+ timeframes align on same divergence

Average R:R on strong confluence entries

Reduction in false breakout trades

Included in Pro • Cancel anytime • No wallet connection required

Everything Else You Didn't Know You Needed.

Portfolio tracking. Emotion analytics. Smart money intel. Performance deep-dives. Eight power features that turn guessing into knowing.

See Every Dollar. Every Exchange.

Stop tab-hopping between Binance, Bybit, and OKX. Your entire portfolio in one screen.

Portfolio Tracker

Portfolio Value

$178,048.11

Assets

5

Open Positions

3

Unrealized P&L

+$1,814

Balances

| Asset | Available | USD Value |

|---|---|---|

| 1.245 | $89,234.56 | |

| 15.832 | $42,156.78 | |

| 245.5 | $28,764.32 | |

USDUSDT | 12,500 | $13,000 |

Open Positions

BTC-PERP

5x • Size: 0.5

+$1415

+4.13%

ETH-PERP

3x • Size: 3.2

+$224

+2.86%

SOL-PERP

2x • Size: 50

+$175

+3.04%

Connect Binance, Bybit, OKX & more • Read-only API access

Your Wallet. Your Business. None of Ours.

We couldn't touch your funds even if we wanted to. No wallet connections. No API keys. No permissions. Just market intelligence that helps you trade smarter.

Security You Can Trust

Fort Knox, But Digital

AES-256 encryption. SOC 2 compliant. The same paranoid security your bank uses, minus the hold music.

We Can't Touch Your Money

No wallet keys. No exchange API. Read-only market data. We literally cannot access your funds.

Your Data Dies With You

We don't sell your trades. We don't share your patterns. We don't even look unless you ask us to.

TradingView Shows You Charts. We Tell You What They Mean.

CoinGlass gives you data. Excel gives you a headache. Ten browser tabs give you ADHD. Thrive puts it all in one place and actually explains what you're looking at.

| Feature | TradingView | CoinGlass | Excel | |

|---|---|---|---|---|

| Real-time Signals | ||||

| AI Interpretation | ||||

| Trade Journal | ||||

| Emotion Tracking | ||||

| Weekly AI Coach | ||||

| Performance Analytics | ||||

| All-in-One Platform | ||||

| No Wallet Connection |

One platform. Everything you need. Stop Frankensteining your trading stack together.

AI Signals → Profitable Trades

Our AI detects high-probability setups. Pair them with smart risk management = consistent 3:1+ R:R trades.

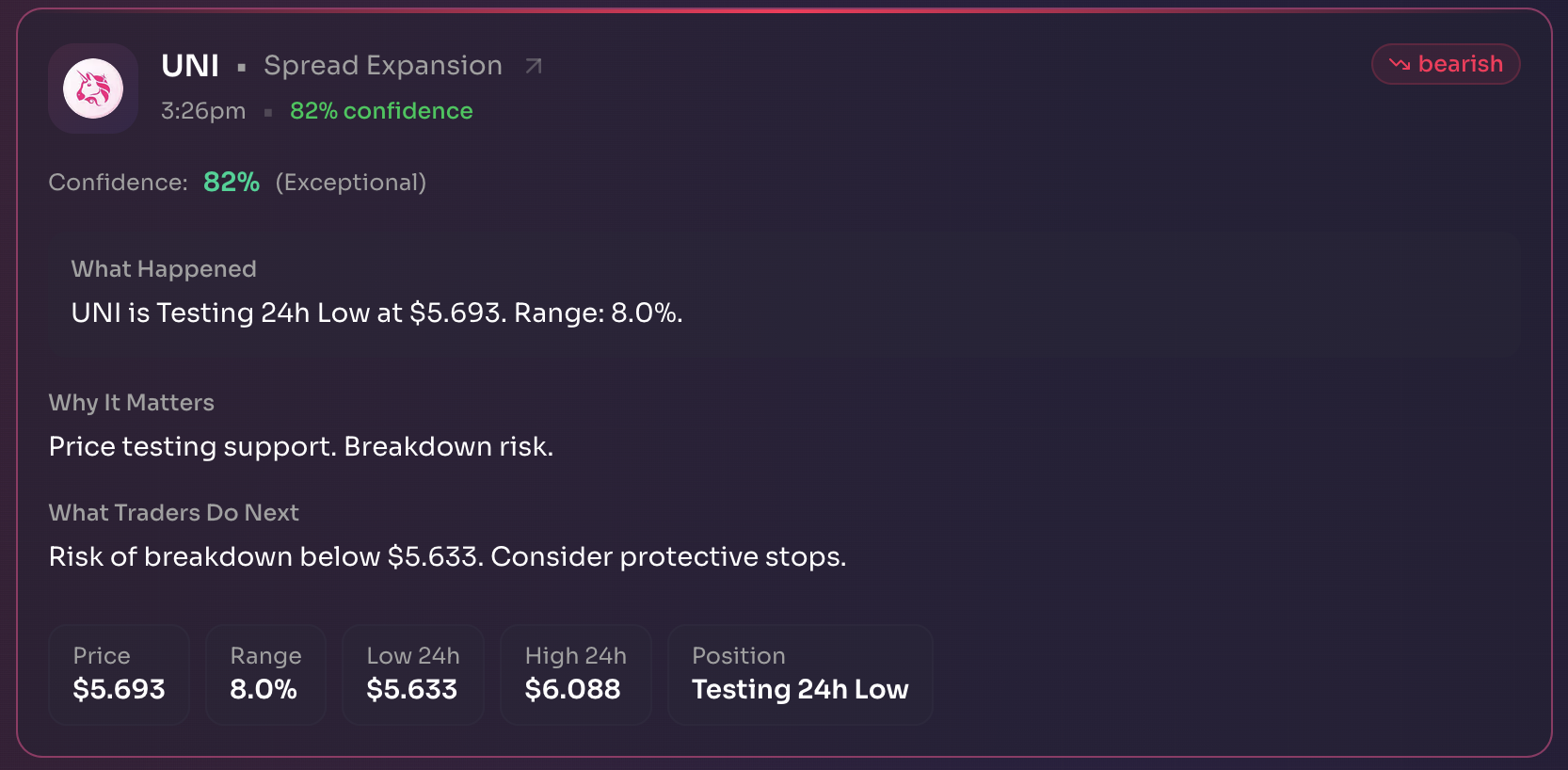

Step 1: Signal received — UNI testing 24h low, breakdown risk identified

Step 2: Price broke down as predicted — 5% move captured with tight risk management

3:26pm

Signal Time

82%

Confidence

3:1

Risk:Reward

+5.07%

Profit

This is what intelligent trading looks like.

AI spots the setup. You manage the risk. Together = consistent 3:1+ trades instead of gambling.

Don't Take Our Word For It. Take Theirs.

“Got a funding flip alert at 3am. Set my alarm. Caught a 6% move.”

“The journal showed me I was revenge trading. Embarrassing to see. Expensive not to.”

“I used to stare at CoinGlass and pretend I understood it. Now the AI just tells me what matters.”

“Finally stopped overtrading. The cooldown reminder saved me thousands.”

“The whale alerts alone are worth 10x the subscription.”

“Caught 3 major reversals this month. All from funding rate signals.”

“My win rate went from 42% to 68% in two months. The data doesn't lie.”

“I sleep better knowing I won't miss overnight liquidation cascades.”

“The AI coach called out my pattern of selling winners too early. Game changer.”

“Stopped chasing pumps after seeing my journal patterns. Painful but necessary.”

“OI divergence alert helped me avoid a fake breakout. Paid for a year of subscription.”

“The liquidation heatmaps are chef's kiss. Know exactly where stops are clustered.”

“My therapist thanks you for the trading journal. So does my portfolio.”

“Finally understand why I was losing on every breakout. Funding rates matter.”

“The psychology tracking is brutal but effective. Can't argue with the data.”

“Whale wallet tracking caught a massive ETH dump 2 hours before it happened.”

“Used to trade on vibes. Now I trade on signals. Huge difference.”

“The weekly AI review roasted my overconfidence. Made me profitable.”

“Exchange outflow alerts + funding flip = perfect long entry. Multiple times.”

“My revenge trading habit is gone. The journal made it impossible to ignore.”

“Worth every penny. The signals are clear and actionable.”

“Caught the SOL bottom with the OI surge alert. Best trade of my life.”

“The AI explains WHY signals matter. Not just what they are.”

“Liquidation cascade warning saved me from a 15% dump. Literally.”

“My position sizing is finally consistent. The journal tracks everything.”

“The funding rate arbitrage signals are printing money.”

“Got a funding flip alert at 3am. Set my alarm. Caught a 6% move.”

“The journal showed me I was revenge trading. Embarrassing to see. Expensive not to.”

“I used to stare at CoinGlass and pretend I understood it. Now the AI just tells me what matters.”

“Finally stopped overtrading. The cooldown reminder saved me thousands.”

“The whale alerts alone are worth 10x the subscription.”

“Caught 3 major reversals this month. All from funding rate signals.”

“My win rate went from 42% to 68% in two months. The data doesn't lie.”

“I sleep better knowing I won't miss overnight liquidation cascades.”

“The AI coach called out my pattern of selling winners too early. Game changer.”

“Stopped chasing pumps after seeing my journal patterns. Painful but necessary.”

“OI divergence alert helped me avoid a fake breakout. Paid for a year of subscription.”

“The liquidation heatmaps are chef's kiss. Know exactly where stops are clustered.”

“My therapist thanks you for the trading journal. So does my portfolio.”

“Finally understand why I was losing on every breakout. Funding rates matter.”

“The psychology tracking is brutal but effective. Can't argue with the data.”

“Whale wallet tracking caught a massive ETH dump 2 hours before it happened.”

“Used to trade on vibes. Now I trade on signals. Huge difference.”

“The weekly AI review roasted my overconfidence. Made me profitable.”

“Exchange outflow alerts + funding flip = perfect long entry. Multiple times.”

“My revenge trading habit is gone. The journal made it impossible to ignore.”

“Worth every penny. The signals are clear and actionable.”

“Caught the SOL bottom with the OI surge alert. Best trade of my life.”

“The AI explains WHY signals matter. Not just what they are.”

“Liquidation cascade warning saved me from a 15% dump. Literally.”

“My position sizing is finally consistent. The journal tracks everything.”

“The funding rate arbitrage signals are printing money.”

“Stopped FOMOing into pumps. The AI shows me when I'm being emotional.”

“The pattern recognition on my trades is scary accurate.”

“Finally have an edge. Not just guessing anymore.”

“The volume profile alerts catch moves before they happen.”

“My drawdowns are 60% smaller since I started tracking psychology.”

“The AI coach is like having a mentor who never sleeps.”

“OI + Funding + Volume = the holy trinity. Thrive tracks all three.”

“Caught the market maker manipulation. The signals don't lie.”

“My P&L went green for the first time in 6 months.”

“The exchange flow data is institutional grade. Insane value.”

“Finally stopped trading against the funding rate. Basic but powerful.”

“The signal explanations helped me learn actual market structure.”

“My emotional trading is documented. Can't hide from it anymore.”

“The 3am alerts are annoying but profitable. Worth the lost sleep.”

“Whale tracking + liquidation levels = unfair advantage.”

“The weekly performance reviews are brutally honest. I needed that.”

“Caught 5 funding flip reversals this month. All profitable.”

“The AI knew I was tilting before I did. Saved me from a bad trade.”

“Position sizing alerts stopped me from going too big. Again.”

“The correlation alerts between BTC and alts are clutch.”

“My trading journal has more insight than 100 YouTube videos.”

“The macro event calendar + signals = perfect storm trading.”

“Finally profitable after 2 years of losing. This platform works.”

“The signal accuracy is insane. 73% hit rate on funding flips.”

“My FOMO is documented and tracked. Can't pretend it doesn't exist.”

“Exchange outflow + whale accumulation = perfect entry signals.”

“Stopped FOMOing into pumps. The AI shows me when I'm being emotional.”

“The pattern recognition on my trades is scary accurate.”

“Finally have an edge. Not just guessing anymore.”

“The volume profile alerts catch moves before they happen.”

“My drawdowns are 60% smaller since I started tracking psychology.”

“The AI coach is like having a mentor who never sleeps.”

“OI + Funding + Volume = the holy trinity. Thrive tracks all three.”

“Caught the market maker manipulation. The signals don't lie.”

“My P&L went green for the first time in 6 months.”

“The exchange flow data is institutional grade. Insane value.”

“Finally stopped trading against the funding rate. Basic but powerful.”

“The signal explanations helped me learn actual market structure.”

“My emotional trading is documented. Can't hide from it anymore.”

“The 3am alerts are annoying but profitable. Worth the lost sleep.”

“Whale tracking + liquidation levels = unfair advantage.”

“The weekly performance reviews are brutally honest. I needed that.”

“Caught 5 funding flip reversals this month. All profitable.”

“The AI knew I was tilting before I did. Saved me from a bad trade.”

“Position sizing alerts stopped me from going too big. Again.”

“The correlation alerts between BTC and alts are clutch.”

“My trading journal has more insight than 100 YouTube videos.”

“The macro event calendar + signals = perfect storm trading.”

“Finally profitable after 2 years of losing. This platform works.”

“The signal accuracy is insane. 73% hit rate on funding flips.”

“My FOMO is documented and tracked. Can't pretend it doesn't exist.”

“Exchange outflow + whale accumulation = perfect entry signals.”

50+

Assets We Watch So You Don't Have To

24/7

Because Crypto Never Sleeps

0

Access We Have to Your Wallet

Is Thrive Right For You?

We'd rather you know upfront than find out later. Thrive works best for a specific type of trader.

Thrive is for you if...

- You actively trade crypto (not just hold)

- You're tired of missing signals while sleeping or working

- You want to improve but don't know what you're doing wrong

- You make emotional trades you later regret

- You're willing to log your trades and learn from them

Thrive is NOT for you if...

- You want guaranteed profits (they don't exist)

- You expect signals to tell you exactly when to buy/sell

- You're looking for a get-rich-quick scheme

- You're not willing to log and review your trades

- You blame tools instead of improving your process

What's NOT Trading Smart Costing You?

Adjust sliders to see your potential losses

Industry average: 15-25%

Emotional trades/month

3

Potential monthly loss

-$180

You could be losing per year

-$2,160

Based on ~12% avg loss on emotional trades

Thrive Pro+ costs $149/month — that's 2x less than what emotional trades could be costing you

One Platform, Everything You Need

What You'd Pay Separately

Real prices from real tools

CoinGlass Pro

Market data & signals

$50/mo

Tradervue

Trade journaling

$30/mo

TradingView Pro

Charts & alerts

$15/mo

Trading Coach

Weekly review & feedback

$200/mo

$149/mo

Save $196+/month

Pick Your Weapon

You've Got Questions. We've Got Answers.

No corporate speak. No weasel words. Just straight talk.

We're going to give you signals that explain themselves, a journal that tracks your psychology, and AI that calls you out when you're being an idiot. The money part? That's on you. Average Pro+ users see a 67% win rate improvement after 30 days. But this isn't financial advice, and we're not your financial advisor. You pull the trigger. We just help you see better.

Pro ($99/mo) gives you solid journaling, top 20 assets with basic signals, and performance tracking. Pro+ ($149/mo) unlocks the full arsenal: all 100+ assets real-time, Smart Money tracking, Hidden Divergence Heatmap, Weekly AI Coach, liquidation data, and whale analytics. Pro builds discipline. Pro+ gives you the edge.

Everything Pro+ gets, forever. Pay $999 once (under 8 months of Pro+) and own it for life. Every v1 feature we build — yours. First access to new features before everyone else. Direct access to our team when you need it. Only 100 of these exist. That number won't change.

Because we wanted to reward the crazy ones who bet on us before we had a track record. $999 lifetime gets you in. After 100? Gone forever. Not a marketing trick — we just want a small group of founding supporters who we can actually talk to.

Actually, yes. Start with Pro to build the habit. The AI explains every signal like you're five. "This happened. Here's why it matters. Here's what traders usually do next." The journal teaches you through the trades you actually make. When you're ready for advanced data, upgrade to Pro+.

Yes. One click. Done. You keep access until your billing period ends. Pro+ Lifetime? That's yours until the heat death of the universe. No refunds on any plan though. This isn't a mattress store. We don't do 30-day trials.

We literally can't. We don't ask for wallet keys. We don't ask for exchange API access. We don't ask for trading permissions. All we see is the same market data everyone sees. Your funds are none of our business — by design.

You could. You'd get charts from one, data from the other, and a headache from switching between tabs. What you wouldn't get: AI that tells you what the data actually means, a journal that tracks your psychology, Smart Money tracking, or weekly coaching that catches your patterns. Different tools, different jobs.

Nope. Not even close. We provide market intelligence and self-tracking tools. Every single decision you make is 100% on you. We're registered as an information service. We're product builders, not financial advisors. DYOR and all that.

Decision Time

You Know What You Need to Do.

The Question Is Whether You'll Do It.

Tomorrow there'll be another signal you miss. Another revenge trade you regret. Another week of wondering why your account keeps shrinking.

Or you could stop the bleeding today.